Endowment Performance

Donor-funded Endowments

Donor-funded endowments at the university work much like a mutual fund: each new fund is assigned shares or units in the university’s Common Investment Fund or CIF, at the previous quarter’s market value. When a fund is established for a specific purpose (such as scholarships, program assistance, etc.), the available income, distributed according to the spending policy, is directed to that purpose. The annual income distribution is allocated to each endowment account in the overall investment pool based on the number of shares assigned to the account.

Any earnings above the spending rate are retained in the investment account to steadily grow the endowment and support earning potential.

The endowment is carefully managed to ensure funds are available in perpetuity; only a small percentage of the market value is spent each year, so that the endowment—and legacy of our donors—endures for the life of the university. The current spending policy, which is set by the Board of Trustees, is 4.4% of the average value of the endowment over the last five years.

Learn more about the university’s endowment spending policy.

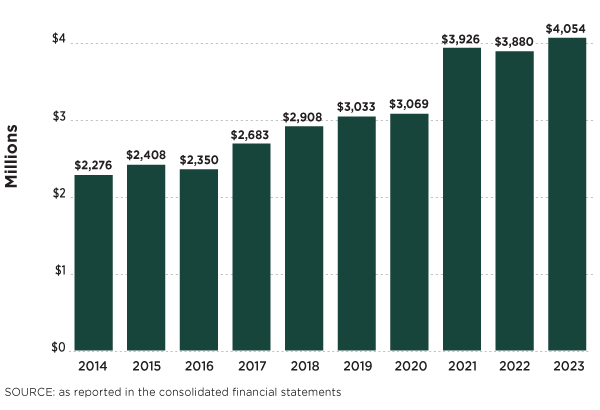

Endowment value over time

As of June, 2023

Investment Objectives of the MSU CIF

- Achieve a total rate of return sufficient to generate the amount annually made available for spending by the university’s programs supported by endowment funds and still provide a modest increase in the inflation-adjusted value.

- Achieve the desired return while assuming only moderate risk.

MSU common investment fund

The MSU Common Investment Fund is the combined pool of the university’s long-term investments. As of June 30, 2023, it was valued at more than $4.0 billion. Over the past five years, the funds generated more than $1 billion for student scholarships, endowed professor support, program support and other annual university expenses.

Benchmark Returns

For the fiscal year which ended June 30, 2023, MSU returned 6.9%, and the long-term performance has allowed us to continue to meet funding obligations to the university.

| Common Investment Fund (CIF) Average Annual Returns as of June 30, 2022 | ||||

| 1 YEAR | 3 YEARS | 5 YEARS | 10 YEARS | |

|---|---|---|---|---|

| CIF Total Return | 6.9% | 13.5% | 10.6% | 9.5% |

| 70/30 Stock/Bond Portfolio (1) | 11.2% | 6.5% | 6.1% | 6.7% |

(1) 70% MSCI All Country World (USD) Index / 30% Bloomberg US Aggregate Bond Index.

For more information about MSU’s CIF performance, please visit the Investment Office.

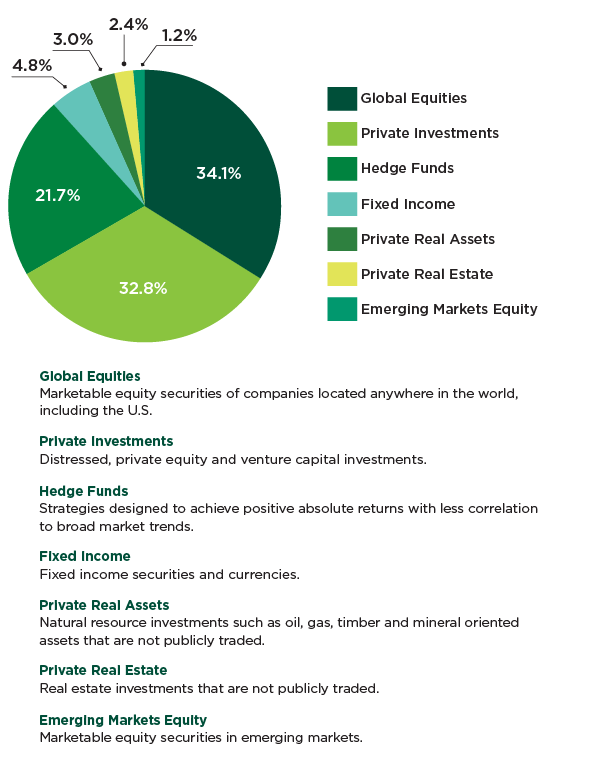

Asset Allocation

MSU seeks to achieve its investment objectives by diversifying across major asset classes as well as within each asset class. The investment policy, approved by MSU’s Board of Trustees, outlines the target asset allocation.

As of June 30, 2023

For more information, please visit the list of investments.

For More Information

For more information on the investment performance of MSU’s CIF and related endowments, please contact Lyndsay Cook, senior director of donor services, at cookly@msu.edu.

If you would like more information on establishing a new endowment through a gift to MSU, please contact Sarah Blom, senior executive director of Individual Giving for University Advancement, at (517) 884-1000 or contact the development officer in the unit you wish to support.

Download the Common Investment Fund report.

Visit My MSU Giving to see your lifetime and annual giving to Michigan State University.